RBI has increased the UPI transaction limit for hospitals and educational institutions

RBI has Mutual funds Subscription, Insurance Premium Subscription and credit card E-order limit for recurring online transactions for reimbursement has been increased from ₹15,000 to ₹1 lakh per transaction.

The Reserve Bank of India has increased the Unified Payment Interface (UPI) payment limit for hospitals and educational institutions from ₹1 lakh to ₹5 lakh per transaction.

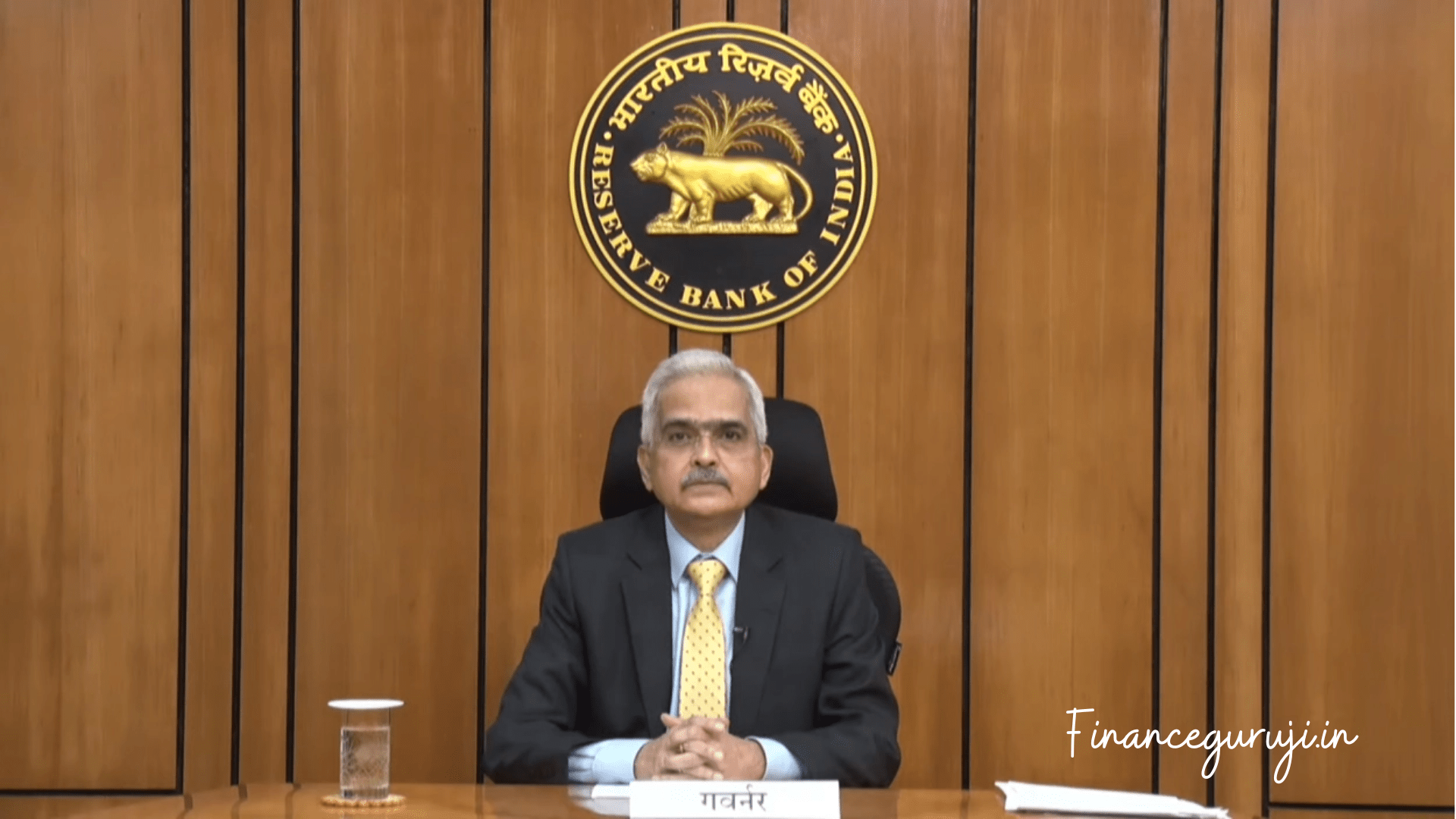

Governor Shaktikanta Das made the announcement while unveiling the bi-monthly monetary policy for December.

“The increased limit will help customers make higher UPI payments for education and healthcare purposes,” he said.

E-orders for recurring transactions

The e-order limit for recurring online transactions has also been raised to ₹1 lakh.

Under the e-order framework, an additional factor of authentication (AFA) is currently required for recurring transactions above ₹15,000.

This is now being extended up to ₹1 lakh for mutual fund investments, insurance premium payments and credit card payments.

“E-orders have become popular among consumers to make recurring payments. The limit is now proposed to be increased to ₹1 lakh per transaction for mutual fund subscription, insurance premium subscription and credit card repayment,” the governor said.

He said that this measure will speed up the use of e-orders.

RBI has proposed to set up a ‘FinTech Repository’.

In another development, the RBI announced the establishment of a “FinTech Repository” to better understand developments in the fintech ecosystem and support the sector.

“It will be operationalized by the Reserve Bank Innovation Hub on or before April 2024. Fintechs will be encouraged to voluntarily provide relevant information in this repository,” Mr. Das said.

Financial institutions such as banks and NBFCs in India are increasingly partnering with fintechs.

Mr. Das also said that the central bank is working on setting up cloud facilities for India’s financial sector.

“Banks and financial institutions are maintaining an ever-increasing amount of data. Many of them are using cloud facilities for this,” he said.

“Adding such a feature will enhance data security, integrity and privacy. It will also facilitate better scalability and business continuity,” he said.

Mr. Das said the intention is to roll out the cloud facility in a calibrated manner in the medium term.